The Real Estate Paradigm Shift: Why Warehouses Beat Offices

The commercial real estate market is witnessing a “silent property revolution,” characterized by a definitive pivot in institutional sentiment and capital allocation. While Global Capability Centres (GCCs) continue to anchor India’s office space demand, the warehousing and industrial sector has definitively overtaken traditional commercial spaces in terms of raw investor interest, scalability, and deal flow. Ultimately, warehouses beat offices as the most lucrative, resilient, and scalable asset class for private equity.

The Rise of GCCs: From Back Office to Innovation Hubs

Global Capability Centres (GCCs) have evolved far beyond traditional outsourcing. India already hosts more than 1,700 GCCs, employing over 1.9 million professionals. Noida is fast becoming the next big GCC destination, driven by cost advantage, talent access, and policy-backed infrastructure. While GCCs anchor premium office space, the sheer physical output and complex supply chain needs they generate further amplify the need for robust warehousing and logistics ecosystems nearby.

If you’d like to know about current opportunities, chat with us on WhatsApp.

Global Trade Diplomacy: The Macro Demand Multiplier

The explosive demand for industrial land along this corridor is deeply intertwined with India’s aggressive reshaping of its global trade relationships. The recent finalization of a landmark trade deal with the European Union (EU) is catalyzing a massive surge in export-oriented manufacturing.

-

-

-

- The EU Trade Deal: Hailed by policymakers as the “mother of all deals,” this Free Trade Agreement (FTA) immediately eliminates or drastically reduces tariffs on over 90% of Indian goods entering the European market.

- The Canada CEPA: Negotiations for a Comprehensive Economic Partnership Agreement (CEPA) with Canada have seen a massive revival, aimed at expanding bilateral trade to over $50 billion by 2030.

- The US Trade Deal Volatility: While the path to a finalized US-India trade agreement is currently experiencing volatility—evidenced by recent US Supreme Court tariff rulings and temporary 10% import duties—we do not yet know exactly when or on what specific terms a deal will be struck. However, a bilateral trade reset is inevitable. When an agreement eventually materializes, explosive growth in export-heavy sectors like pharmaceuticals, textiles, and engineering will drive massive, immediate demand for export-compliant warehousing.

-

-

When tariffs drop, export volumes surge, necessitating the immediate acquisition of vast tracts of industrial land to build larger factories and export-compliant warehousing.

Unlocking Micro-Markets: Direct Access and Property Price Escalation

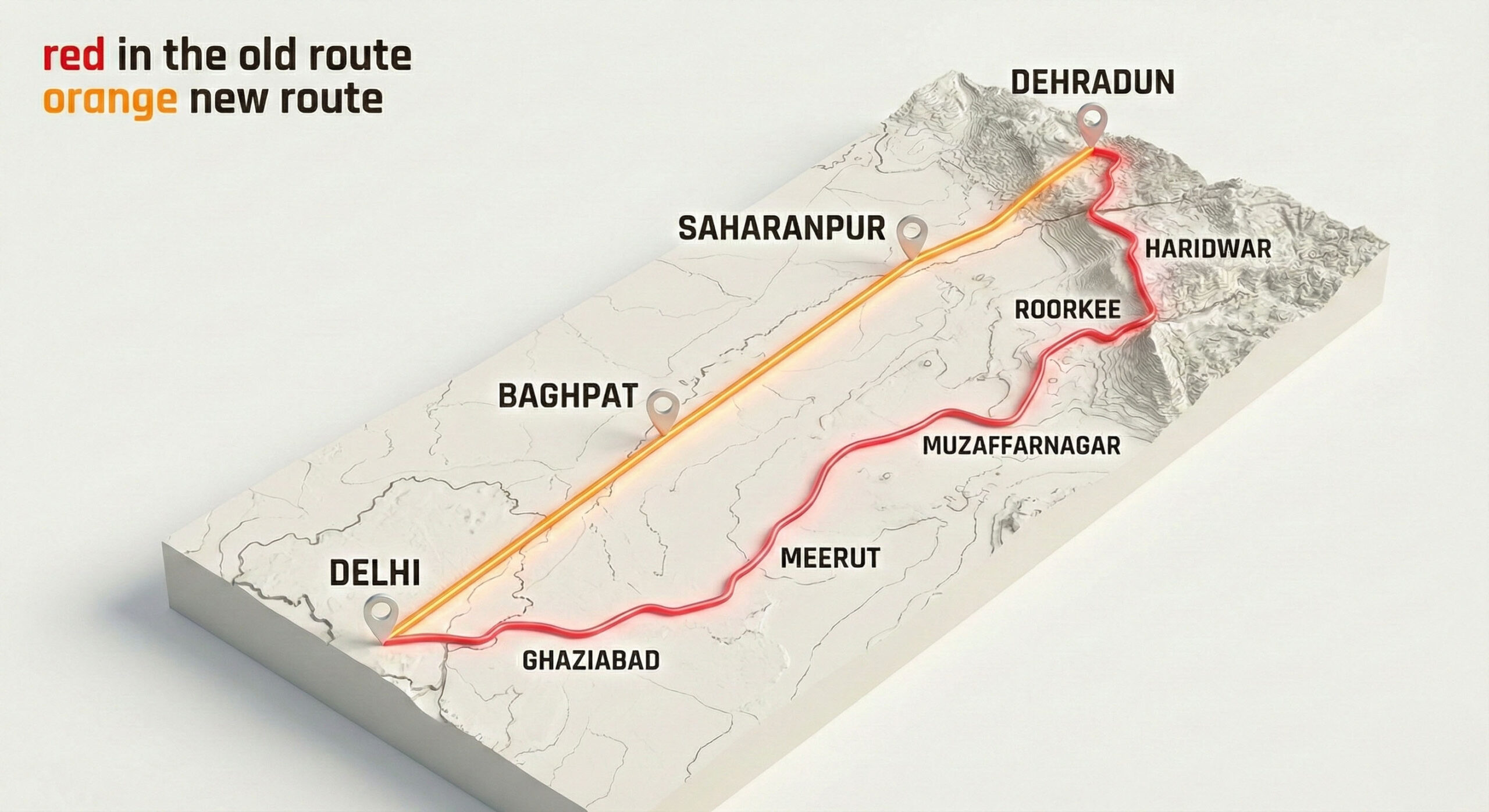

The true wealth generation potential lies in meticulously dissecting the engineering mechanics of the expressway. Phase I, the critical 32-kilometer brownfield stretch, originates at the iconic Akshardham Temple in Pandav Nagar, Delhi, and terminates at the Eastern Peripheral Expressway (EPE) interchange in Baghpat.

For the logistics sector, the strategic placement of access points fundamentally alters commercial viability. Vehicles can seamlessly enter the expressway from Akshardham, the Geeta colony, and the Khajuri Pusta Marg area. The Khajuri Pusta Marg access point is of paramount importance for businessmen and logistics operators situated in and around the Khureja colony and Shastri Park. Historically, moving commercial freight from the Khureja colony or the Geeta colony out of Delhi required navigating hours of crippling gridlock. Now, it is an immediate logistical extension of Delhi.

Furthermore, the efficiency of the expressway is multiplied by its seamless integration with existing networks, incorporating independent stretches of NH709. Crucially, the corridor includes a spur engineered specifically to alleviate the crushing traffic burdens currently borne by NH58.

The Baghpat Arbitrage: The Premier Hub for Freehold Industrial Land

As the corridor opens, geographic zones previously deemed too remote are suddenly brought within a highly manageable 30-to-45-minute radius of Central Delhi. Among these, the district of Baghpat stands alone as the epicenter for industrial, shed, and warehousing investment.

Financially, the arbitrage opportunity is staggering. While industrial land in saturated hubs like Ghaziabad averages ₹7,645 per square foot, Baghpat continues to offer highly affordable entry points at approximately ₹3,566 per square foot. Most importantly, unlike the leasehold models prevalent in Noida and the Yamuna Expressway, Baghpat is uniquely positioned to offer freehold industrial land. Freehold ownership allows businesses absolute, indefinite ownership, significantly simplifying property transactions and easing access to institutional financing.

Corporate Pioneers Validating the Corridor

The theoretical potential of the Baghpat industrial corridor is already being overwhelmingly validated by massive capital deployments from corporate heavyweights.

- Amul: India’s premier dairy cooperative signed a Memorandum of Understanding to invest ₹900 crore in Uttar Pradesh, earmarking ₹800 crore specifically for a massive processing plant in the Baghpat district.

- Bimbo Bakery: Grupo Bimbo, after acquiring the Modern Foods brand, executed a massive land acquisition in Baghpat, injecting an estimated ₹550 crore to dominate the distribution network across North India.

For the astute industrial real estate investor, acquiring freehold land in Baghpat today is akin to buying prime commercial real estate before the anchor tenants have fully opened their doors.

Seizing the First-Mover Advantage

As the final phases prepare for their highly anticipated inauguration in early 2026, the window for securing foundational assets is narrowing rapidly. Securing freehold land in key nodes like Baghpat prior to the full stabilization of commercial traffic patterns will yield immense first-mover advantages, translating to outsized capital appreciation and robust, long-term rental yields.

For inquiries, project details, or to discuss freehold land opportunities, you can call us directly at +91 92205 94889.