Why India’s HNIs Are Choosing Land Over Apartments in 2025

In 2025, a significant transition is taking place across India’s luxury real estate market: many high-net-worth individuals (HNIs) are declining to purchase apartments and are choosing to purchase plots of land instead. Market experts suggest that wealthy buyers are increasingly viewing land as a finite, continuing asset, whereas apartments depreciate. This is magnified in growing hubs like Noida, where premium buyers prefer land in terms of space and valuation. One report in the realty space stated that HNIs “are shifting gears,” away from taking care of individual flats, to opting for professionally managed, or in this case land assets.

There are several reasons that justify this trend:

There are several reasons that justify this trend:

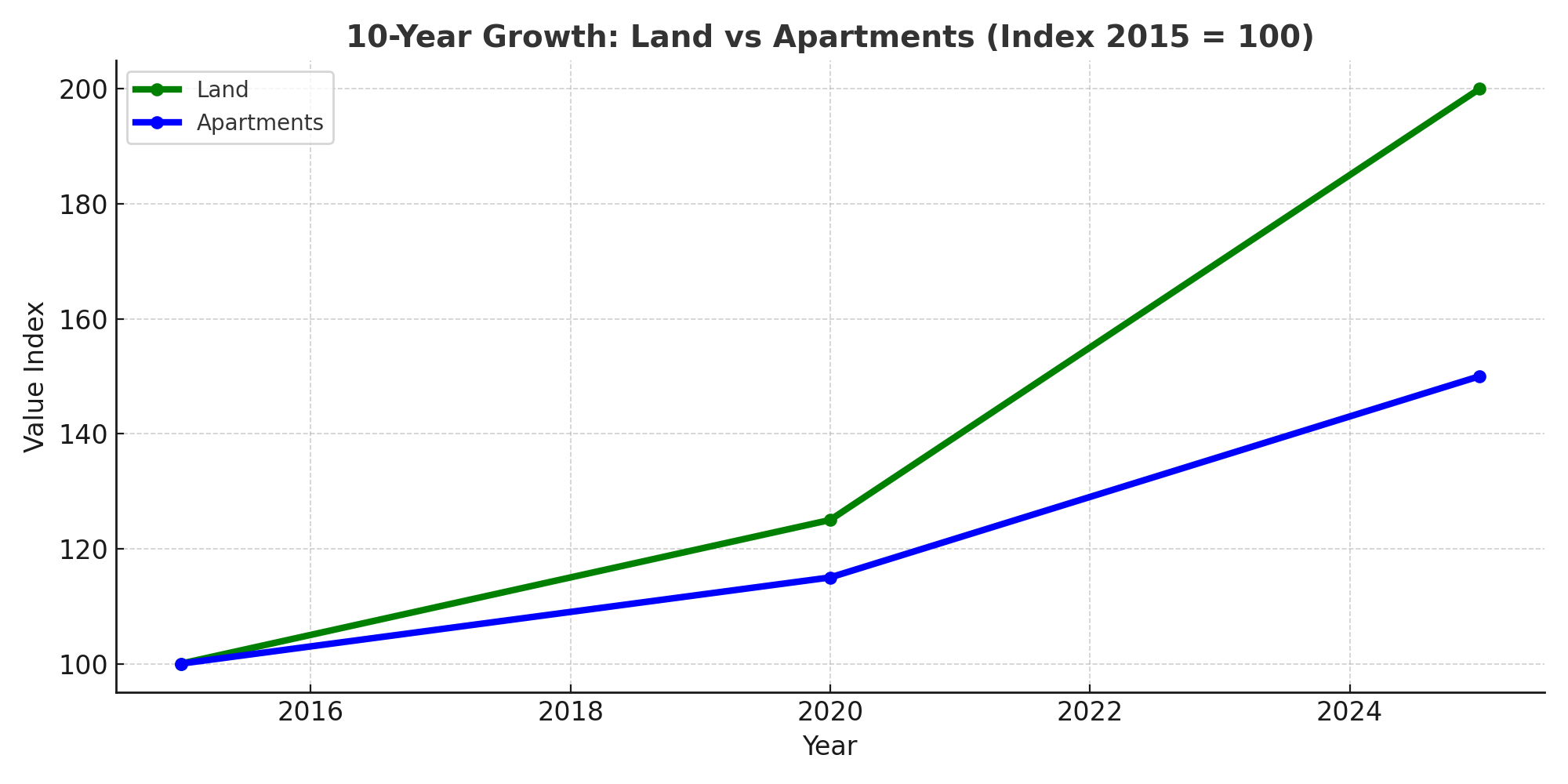

- There are several reasons that justify this trend: Land as a tangible, non–depreciating asset: Land, unlike apartments (which depreciate and lose value), is a finite resource whose value appreciates over time. Experts agree that lots “don‘t depreciate“ because there is no dwelling to then age. In many new emerging corridors land prices are growing faster than apartments. For example, a recent data analysis found that prime peripheral land had greater price appreciation than the city flats. For example, a similarly placed land and apartment investment over a 10 year period, returned about 144% total on land vs ~130% (which includes rental income) for apartments. Basically, in most cases, land has produced better capital growth, and without depreciation in the structure.

- Flexibility and Customizability: A plot allows buyers the option to plan a custom home. Affluent families appreciate this opportunity as they can design their customized residence – for example, assess if they will build multi-generation villa or whether they will build and expand over time. Apartment owners have their building and size belongings fixed. Analysts point out that HNIs value the “privacy of independent living” and the option to build at their own time-skill.. As (VaEdifice a well-known developer from Noida) said the “goal is to “create a home… built to last… built to remain a legacy”.” The emotional value behind land and self-designed homes is important to buyers who want to pass wealth (land) and custom home for their future generations.

- Less maintenance and more ongoing returns: generally, land is less maintenance than an apartment building. Generally, plotted developments have very low recurring common maintenance costs while owners of flats are paying significant society or builder monthly fees for things like access/security/repairs. Flats also wear out and need renovations, it’s another expense. In a real estate report just out the other day, you have as asset value, “land cannot be depreciated” and “the structure deprecates,” for apartments. The same report said, “land has no ongoing maintenance,” while a flat will have ongoing maintenance. Again, so plotted land is less ongoing annual carrying costs, which is attractive to a keeping capital class of investors.

- Investment Mindset: The post-pandemic homebuyer is more strategic. Many HNIs now treat homes as part of a portfolio. Economic Times notes that Indian HNI investors are moving “away from direct ownership” of apartments, preferring structured vehicles (AIFs) or land where returns and management hassle are clearer. They want to be investors, not landlords, and land offers both high appreciation potential and the option to lease or develop later. Indeed, surveys suggest over half of wealthy Indians place significant capital in real estate – but increasingly in ways that don’t tie them to managing a flat.

Source: Industry analysis (Knight Frank, Anarock, ET Realty, CREDAI reports 2015–2024). Data indicative, for trend illustration only.

All this paints apartments as being not for everyone. In fact, experts say apartments suit buyers with different priorities. For instance:

- Apartments appeal to those seeking ready living and liquidity. You move in right away and can rent it out immediately. Flats also have lower financing costs (housing loans) and easier resale in urban markets. First-time investors or families valuing convenience often choose flats for these reasons.

- Plots are ideal for long-term capital seekers. If your goal is maximum appreciation and to build a custom legacy home, land is preferable. Indians especially see land as a “tangible, generational asset”. One guide succinctly puts it: plots have “no depreciation” and higher appreciation potential, whereas flats give steady rental income and convenience.

In short, residential plots and villas are fast gaining favor among well-heeled Indians in 2025, even as apartments remain a mainstream option. Investors focusing on legacy, flexibility, and high growth see land as a superior asset (and as VaEdifice’s motto suggests, a home on land becomes “a lasting legacy”). Apartments still serve buyers who prioritize amenities and immediate cash flow, but for HNIs building generational wealth, land increasingly equals legacy while apartments risk sliding value.

In short, residential plots and villas are fast gaining favor among well-heeled Indians in 2025, even as apartments remain a mainstream option. Investors focusing on legacy, flexibility, and high growth see land as a superior asset (and as VaEdifice’s motto suggests, a home on land becomes “a lasting legacy”). Apartments still serve buyers who prioritize amenities and immediate cash flow, but for HNIs building generational wealth, land increasingly equals legacy while apartments risk sliding value.

Who Should Consider Apartments? Obviously, not all buyers should switch to plots. Luxury flats may still work for younger professionals or global investors who want turnkey homes with facilities, or for HNIs targeting regular rental yield. The Housivity analysis advises: choose an apartment if you want immediate income, ready usability, and liquidity. But when in doubt, wealthier buyers are asking themselves if a mall-quality gym and club at a tower outweigh owning land they can pass on.

Conclusion: High-net-worth homebuyers in NCR and across India are increasingly drawn to land for its enduring value and freedom. News outlets observe that HNIs are “absolutely participating” in real estate – but often through land or funds rather than owning flats. As 2025 unfolds, the narrative is clear: land = legacy, apartments = depreciation. VaEdifice and other experts advise that while flats have their niche, luxury investors looking for legacy and high appreciation should strongly consider plotted properties.

Sources: Market reports and realty analyses provide data and expert quotes on this emerging trend.